Wake County Tax Real Estate Records

Real Estate Wake County Government

Get information on what is taxed as real estate property and annual tax bills. Real estate property includes: - Land - Buildings - Structures - Improvements - Permanent fixtures - Mobile homes that are placed upon a permanent enclosed foundation on land owned by the owner of the mobile home.

https://www.wake.gov/departments-government/tax-administration/real-estate

Tax Administration Wake County Government

The Wake County Department of Tax Administration appraises real estate and personal property within the county, as well as generating and collecting the tax bills. The department also collects gross receipts taxes. Find important information on the department’s listing and appraisal methods, tax relief and deferment programs, exempt property and procedures for appeals.

https://www.wake.gov/departments-government/tax-administration

2025 Property Tax Bills Wake County Government

The Wake County Board of Commissioners voted on June 2 to adopt a $2.1 billion budget for Fiscal Year 2026. It will increase the County’s investment in the Wake County Public School System’s operating budget by $40.3 million, which matches the Board of Education’s funding request, bringing the County’s total investment in the school district’s operations to $742.9 million.

https://www.wake.gov/departments-government/tax-administration/tax-bill-help/2025-property-tax-bills

North Carolina property tax changes: what to expect in 2026

North Carolina could get a new law about property taxes in 2026, if some state House members have their way. Republican House Speaker Destin ...

https://www.newsobserver.com/news/politics-government/article313760752.html2026 Individual Property Listing Form Web- Wake County

Enter physical location of listed property as of January 1, 2026. If listing property at multiple locations, please complete a separate listing ...

https://s3.us-west-1.amazonaws.com/wakegov.com.if-us-west-1/s3fs-public/documents/2025-12/2026%20Individual%20Property%20Listing%20Form%20Web.pdfWake County Property Records Owners, Deeds, Permits

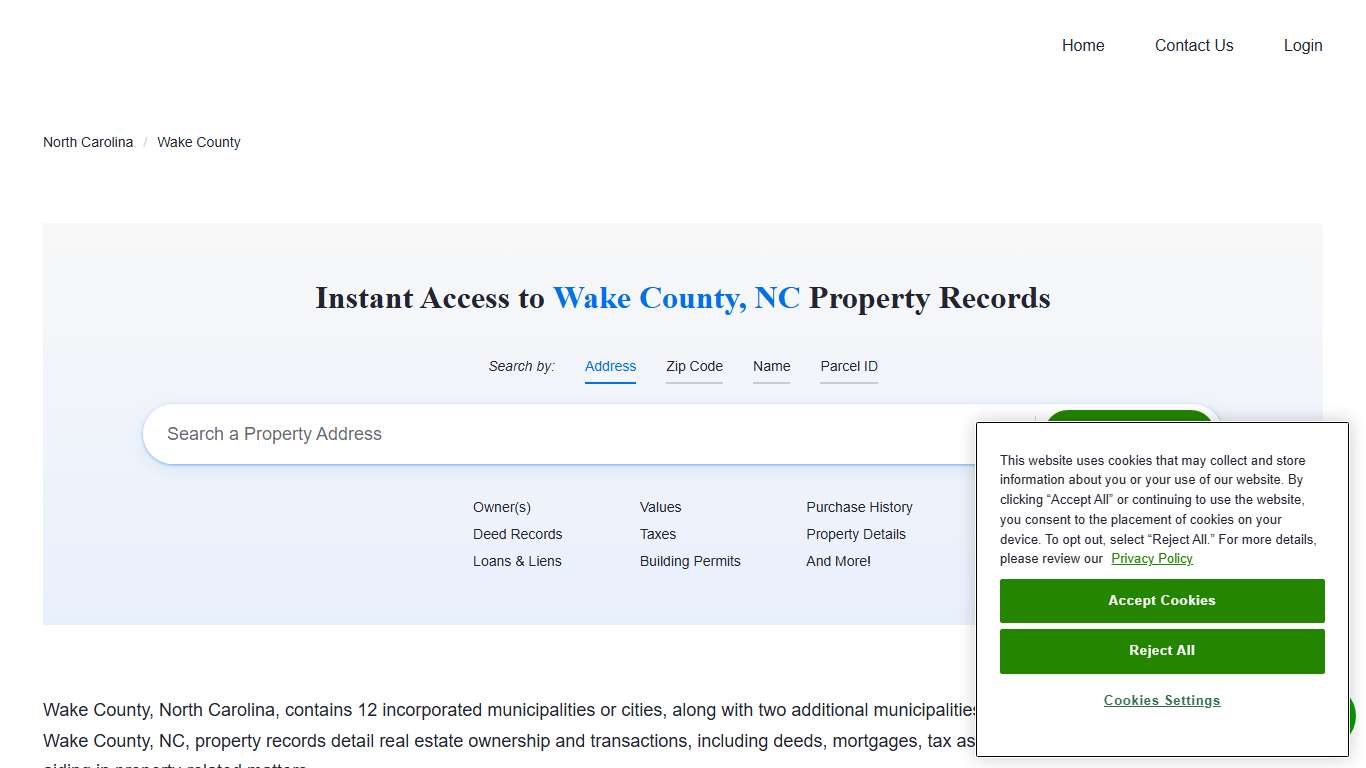

Instant Access to Wake County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Wake County, North Carolina, contains 12 incorporated municipalities or cities, along with two additional municipalities that extend partially into the county.

https://northcarolina.propertychecker.com/wake-county

Property Tax - Forms NCDOR

Some NCDOR offices may be closed to the public today. Please call ahead if you need to visit an office. Help is also available by calling 1-877-252-3052. A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms

Property tax assistance options in Wake County Habitat for Humanity Wake County

Homeowners throughout Wake County are facing increased difficulty affording property tax bills. Over the past few years, property taxes have increased by over 100% in some areas of the county. Property taxes play a key role in providing services and infrastructure that our community needs.

https://www.habitatwake.org/propertytax

Property tax assistance options in Wake County Habitat for Humanity Wake County

Homeowners throughout Wake County are facing increased difficulty affording property tax bills. Over the past few years, property taxes have increased by over 100% in some areas of the county. Property taxes play a key role in providing services and infrastructure that our community needs.

https://www.habitatwake.org/propertytax

Taxes Wake County Economic Development

2025 County and Municipal Property Tax Rates: Local property tax rates are calculated against each $100 in value. If you live in a city or town, you will pay both county and municipal property taxes, plus any additional special taxes that apply.

https://raleigh-wake.org/invest-expand-thrive/taxes

Wake County Property Records Owners, Deeds, Permits

Instant Access to Wake County, NC Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Wake County, North Carolina, contains 12 incorporated municipalities or cities, along with two additional municipalities that extend partially into the county.

https://northcarolina.propertychecker.com/wake-county